Soybean Market Size Worth USD 310.07 Billion by 2034 | Towards FnB

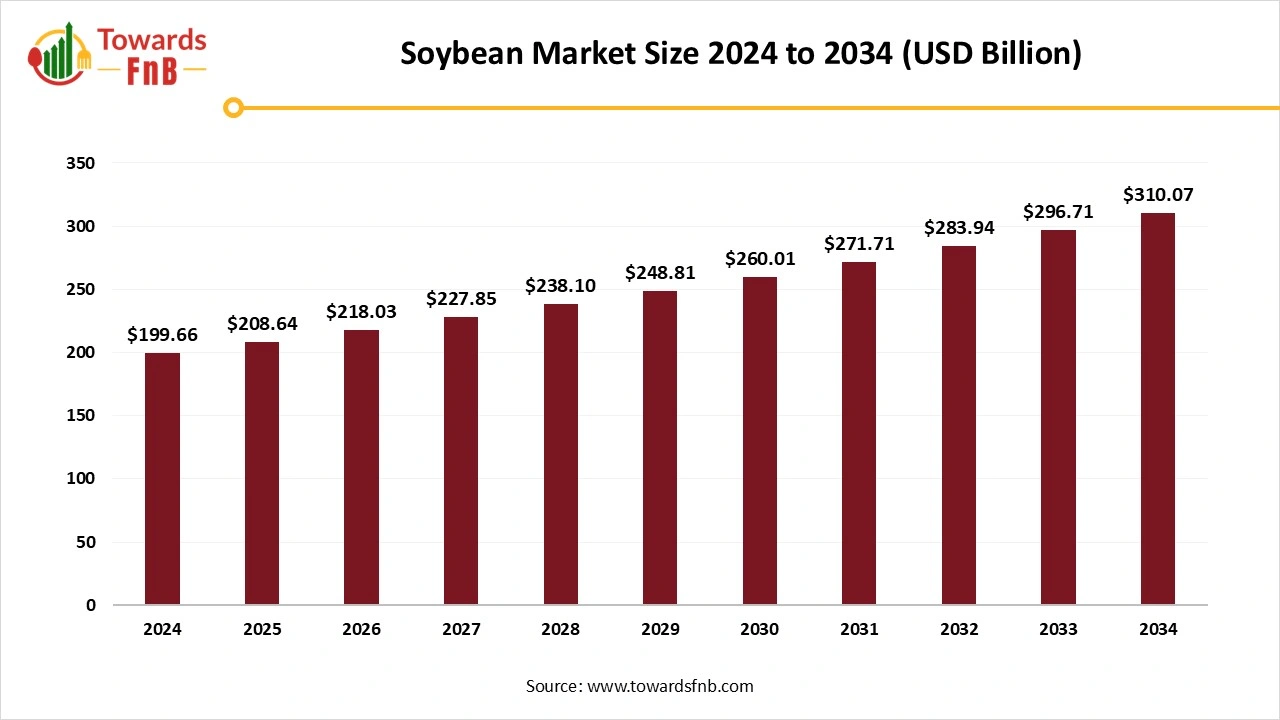

According to Towards FnB, the global soybean market size is evaluated at USD 208.64 billion in 2025 and is anticipated to surge USD 310.07 billion by 2034, reflecting at a CAGR of 4.5% from 2025 to 2034. This steady expansion highlights the increasing role soybeans are playing in both food and agricultural industries worldwide.

Ottawa, Nov. 04, 2025 (GLOBE NEWSWIRE) -- The global soybean market size stood at USD 199.66 billion in 2024 with projections indicating a rise from USD 208.64 billion in 2025 to reach USD 310.07 billion by 2034, according to a report published by Towards FnB, a sister firm of Precedence Research.

The market is observed to grow majorly due to growing veganism, rising population adapting plant-based diets, enhancing the nutritional quality of livestock and animal feed, and the manufacturing of plant-based products such as tofu, soy sauce, and soy milk.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5528

Key Highlights of the Soybean Market

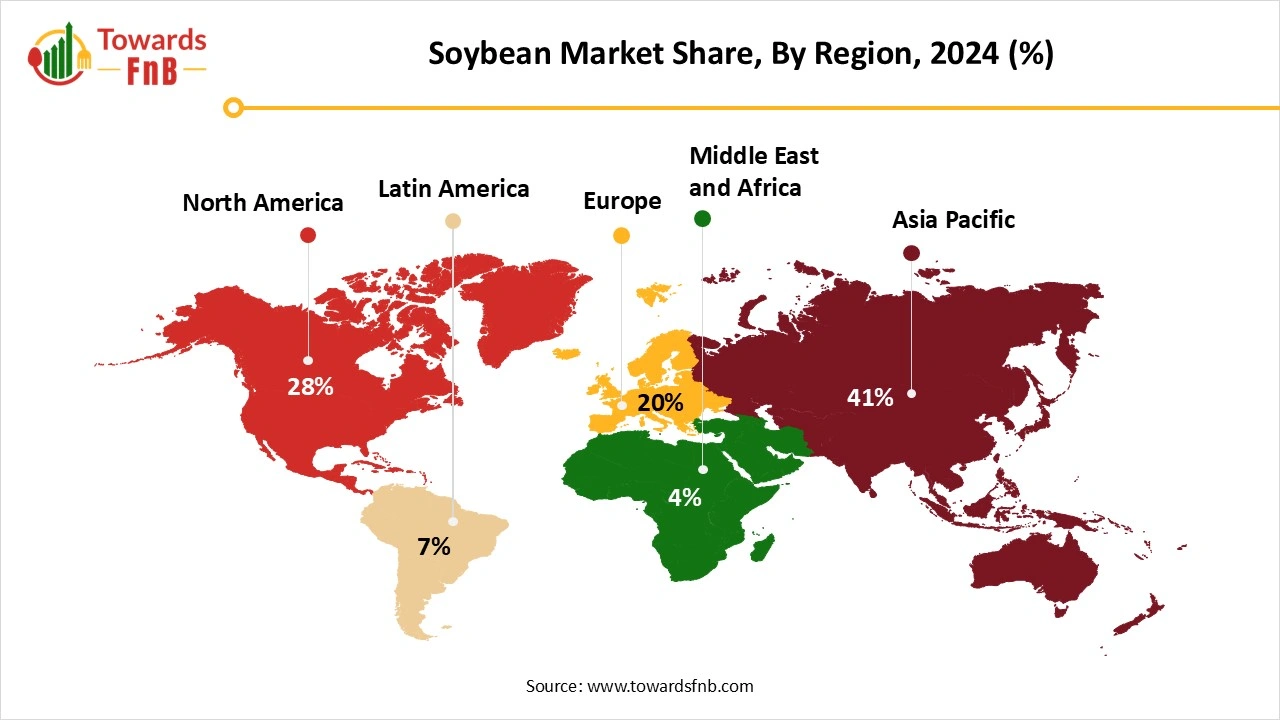

- By Region, Asia Pacific dominated the market with the largest share of 41% in 2024. Consumers in this region are highly conscious of health concerns related to the excessive consumption of products, particularly those high in saturated fats and cholesterol.

- By Region, North America is expected to experience significant growth during the forecast period. The expanding population, heightened consumer awareness, and the pressures of climate change are driving the increasing demand for sustainable nutrition and energy.

- By Nature, the GMO segment captured the largest market share, accounting for 84% in 2024. As crop production surged, agricultural experts developed innovative growing systems, fertilizers, and genetically engineered seeds to improve the yields of mass-produced crops, especially soybeans.

- By Nature, the non-GMO segment is projected to grow at the fastest rate during the forecast period. With positive consumer attitudes towards non-GMO products, there is a growing demand for natural, perceived healthier food options.

- By Form, the processed soybean segment held the largest share, contributing 85% to the market in 2024. Soybean is widely recognized for its high protein content, and its health benefits are particularly significant in regions like Nigeria.

- By Form, the raw soybean segment is expected to experience the fastest growth during the forecast period, with strong demand in China, where soybeans are widely used for animal feed and soy-based food products.

- By End-Use, the animal feed segment generated the largest market share, accounting for 73% in 2024. The effective use of soybeans in the livestock industry has become crucial for enhancing animal productivity and health.

- By End-Use, the food and beverage segment is anticipated to grow the fastest during the forecast period. Soybeans are increasingly used in the production of dairy products like formula milk powder and liquid milk.

Versatility of Ingredients is helpful for the Growth of the Soybean Industry

The soybean market has been growing lately due to high usage in the manufacturing of animal feed and biofuels. The legume is high in protein and is essential for the manufacturing of different types of food options, such as tofu, soy sauce, cooking oil, and soy milk as well. These plant-based options are also highly demanded by vegans and plant-based diet followers, further fueling the growth of the market. The legumes has higher usage in Asia countries for the preparation of traditional dishes.

Soybeans are also an essential part of various other industries apart from nutrition. Hence, the beneficial ingredient is also utilized for the manufacturing of eco-friendly fuels, crayons, engine lubricants, and candles. The market also plays a major role in the growth of the livestock industry. A soybean-infused diet, rich in protein, helps in enhancing the nutritional levels of cattle and poultry, further fueling the industry’s growth. Hence, the versatility of the legume is helpful for the growth of the soybean industry.

Major Soybean Producing Countries

| Market | Total Production (in metric tons) | Percentage of Global Production in 2024-25 | |

| Brazil | 169 million | 40 | % |

| United States | 118.84 million | 28 | % |

| Argentina | 50.9 million | 12 | % |

| China | 20.65 million | 5 | % |

| India | 12.58 million | 3 | % |

| Paraguay | 10.2 million | 2 | % |

| Canada | 7.57 million | 2 | % |

| Ukraine | 7.2 million | 2 | % |

| Russia | 7.05 million | 2 | % |

| Uruguay | 4.2 million | 0.99 | |

(Source- https://www.fas.usda.gov/data/production/commodity/2222000)

The table above depicts the data of the top 10 countries of 2024-25 producing soybeans and using them for the manufacturing of different products. China, with 3% of total global production, and India, with 3% of total production, ranking at the 4th and 5th position respectively, depict the dominant soybean market in 2024-25, whereas the leading position of the United States with 28% of total global production depicts North America’s market growth in the foreseen period.

New Trends of the Soybean Market

- Higher usage of soybeans in animal feed and livestock for maintaining the nutritional profile of animals is a major factor for the growth of the market.

- Government initiatives and support for the manufacturing of biodiesel and biofuel are another major factor for the growth of the market.

- A growing population of health-conscious consumers, such as vegans and plant-based diet followers, demanding plant-based proteins, is another major factor for the growth of the market.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/soybean-market

Recent Developments in the Soybean Market

- In October 2025, in India, Madhya Pradesh launched a price deficiency support scheme- Bhavantar- for soybean farmers, to protect them from a fall in the mandi prices. The scheme will pay the difference between the lower market price and the minimum support price to farmers. (Source- https://www.financialexpress.com)

- In October 2025, Blue Tribe Foods, the clean-label food brand, launched its two new plant-based products- the Korean Soya Chaap and fiery Spicy Kebab. The products avoid the use of refined flour, palm oil, and trans-fat, making it a healthier and plant-based option with a cultural fusion taste. (Source- https://nuffoodsspectrum.in)

Impact of AI on the Soybean Market

Artificial intelligence is reshaping the soybean market by enhancing productivity, sustainability, and market intelligence across the agricultural value chain. In cultivation, AI-powered precision agriculture tools use satellite imagery, drones, and sensors to monitor soil health, moisture levels, pest infestations, and crop growth in real time. Machine learning algorithms analyze this data to optimize planting schedules, irrigation, and fertilizer application, significantly improving yield while reducing input costs and environmental impact. Predictive analytics also help farmers anticipate weather changes and disease outbreaks, enabling proactive crop management and reducing losses.

In processing and supply chain management, AI-driven automation improves sorting, grading, and quality control by using computer vision systems to detect impurities, color variations, or damaged beans. AI also optimizes oil extraction and meal production processes, ensuring consistent product quality and operational efficiency. Supply chain analytics powered by AI enhance logistics, demand forecasting, and price prediction, helping producers and traders make data-driven decisions in a market influenced by global trade dynamics and climate variability.

From a market and consumer perspective, AI analyzes consumption trends and health data to support innovation in soy-based products such as plant-based meat, dairy alternatives, and protein supplements. Additionally, AI supports sustainability tracking, helping producers monitor carbon footprints and comply with ESG (Environmental, Social, and Governance) goals.

Soybean Market Dynamics

What are the Growth Drivers of the Soybean Market?

Multiple factors are driving the growth of the soybean market. Higher demand for plant-based protein options among vegans and vegetarians is a major driver of soybean industry growth. Such food options are also low in cholesterol and fats, further fueling the market’s growth. Such options are also helpful for the production of eco-friendly biofuels and diesels, thereby promoting the market. As an environmentally friendly and useful crop, the government promotes its use across various industries, further enhancing market growth. Another major factor in the market's growth is the use of soybeans in animal feed and livestock to enhance animals’ nutritional levels.

Challenge

Issues in the Smooth Soybean Production Chain Hampering the Market’s Growth

Issues observed by soybean cultivating farmers are one of the major issues observed in the growth of the soybean market. The farmers cultivating the crop may face issues due to climatic conditions, complexities in getting credit, and issues observed due to the higher cost of agrochemicals as well. Reduction in the overall production of soybeans due to various reasons is another issue observed in the growth of the industry.

Opportunity

Contribution to Eco-Friendly Practices Is Helpful for the Market’s Growth

Soybean is a versatile crop helpful for the manufacturing of different types of plant-based options. Hence, the market has a huge consumer base of vegans, plant-based diet followers, and consumers practicing sustainability. The crop can be used for the manufacturing of eco-friendly biofuels and biodiesel, plant-based meat, manufacturing materials, adhesives, and many other eco-friendly options. Hence, the market has usage in multiple domains, leading to a huge contribution to the market’s growth in the future.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5528

Soybean Market Regional Analysis

Asia Pacific Led the Soybean Market in 2024

High demand for plant-based protein options is one of the major factors for the growth of the soybean market in 2024. Higher demand by vegans and plant-based diet followers for health-conscious options helps to fuel the market’s growth. Such options are low in fats and cholesterol and hence are healthier for consumers with different types of health issues.

Plant-based food options made from soybeans are helpful for environmental balance, lower greenhouse gas emissions, and lower water pollution. Hence, many consumers are turning to veganism or vegetarianism to do their bit for the environment. China, being the largest producer of soybeans globally, makes a major contribution to the growth of the market in the region.

North America Is Expected to Grow in the Foreseen Period

North America is observed to be the fastest-growing region in the foreseen period due to factors such as a growing population, higher demand for sustainable nutrition options, and continuous climate change. Such factors are highly pressurizing the soy farmers of the region to enhance crop cultivation to meet the growing demands, further fueling the growth of the market. Higher production of soybeans in Canada leads to its major contribution to the growth of the market in the region.

Europe Is Expected to Grow with Notable Growth in the Foreseeable Period

Europe is expected to experience a notable growth in the soybean market in the foreseeable period due to factors such as smooth imports in the region, higher demand for non-GMO options, and consumer awareness regarding the nutritional importance of the crop. Higher demand by the plant-based diet followers and vegans for healthier options is another major factor for the growth of the market in the region.

Trade Analysis for the Soybean Market

Brazil: Brazil is the world’s dominant soybean exporter in recent seasons, supplying very large bulk shipments into global markets and stepping in to meet demand where other origins faced constraints. Recent harvests and expanded export logistics have pushed outbound shipment capacity to record levels, reinforcing Brazil’s role as the principal origin for raw soybean flows feeding crush plants and feed mills worldwide.

Key statistics

- Recent annual export volumes (latest seasons): on the order of tens of millions of metric tons (record-level seasons have seen > 50 million tonnes in exports for a single year).

- Typical shipment profile: large bulk vessel loads (Panamax/Capesize) and containerized smaller consignments for specialty-quality lots; typical bulk parcel sizes measured in tens of thousands of tonnes per vessel.

Government initiatives

- Port and hinterland logistics investments, export-facilitation support from national and state agricultural agencies, and policies encouraging crop expansion and infrastructure modernization to reduce inland bottlenecks.

United States: The U.S. remains a major exporter of soybeans and soy products (beans, meal, oil), with trade patterns influenced by seasonal crop cycles, contract commitments, and shifting destination portfolios. U.S. shipments tend to combine large bulk exports with numerous smaller consignments of value-added soy products. Recent trade dynamics reflect competitive pressures from other origins and evolving buyer diversification.

Key statistics

- Recent annual export volumes (beans + products): multi-tens of millions of metric tons in combined outbound shipments (beans and processed products).

- Shipment types: large bulk vessel shipments for raw beans; palletized and containerized loads for soymeal, oil, and packaged feed/meal consignments; many high-value consignments are shipped in small to mid-sized lots for food-grade or specialty uses.

Government initiatives

- Trade promotion and export-assistance programs, support for port infrastructure and inspection capacity, and policy responses to international trade frictions that affect destination markets.

Argentina: Argentina plays a dual role as a raw-bean exporter and a major processor-exporter of soymeal and soybean oil. Trade flows are sensitive to domestic crush economics and export policy settings. Recent seasons have seen fluctuations in exportable bean volumes as internal processing, export tax regimes, and logistics reshape shipment patterns.

Key statistics

- Recent export shipments of raw soybeans and downstream products: millions of tonnes annually, with year-to-year shifts as domestic crushers and export markets rebalance.

- Typical consignment profile: mix of bulk vessel shipments for raw beans and smaller parcel/container loads for processed meal and oil destined for regional buyers.

Government initiatives

- Policies affecting crush vs. raw-export incentives, port and rail logistics investments, and export-policy measures that periodically alter the relative flows of beans vs. processed products.

China (primary importer & crusher): China is the single largest market driver for global soybean trade, importing massive volumes for crushing into meal and oil for feed and food processing. China’s destination demand shapes seasonality, origin sourcing, and freight routing across the Atlantic and Pacific corridors. Recent shifts in China's sourcing mix influence which origins dominate shipments in any given season.

Key statistics

- Monthly and seasonal import bursts: in recent years, single months have seen single-digit to double-digit million-tonne import arrivals (e.g., monthly peaks in the 10–13 million tonne range in heavy months).

- Sourcing mix: procurement patterns can shift rapidly between major origins (e.g., Brazil, U.S., Argentina) depending on price, logistics, and trade policy.

Government initiatives

- Import tariff settings, sanitary and phytosanitary measures, and strategic buying programs that can accelerate or dampen import flows in a season; policies aimed at securing stable feed supplies for the livestock sector also influence purchasing cadence.

Netherlands & Belgium (EU gateway & re-export hubs): Northern European ports are central aggregation and redistribution points for soy products entering the EU, including soybeans, soymeal, and soy oil destined for regional crushers, feed mills, and processors. These hubs also support value-added trade, certification, and sustainability verification flows.

Key statistics

- Inbound volumes (imports for EU redistribution) run into millions of tonnes of soybean-equivalent (meal/oil equivalents) annually; a substantial share is re-exported within the EU.

- Typical shipment sizing: large bulk parcels for feed/processing; frequent smaller consignments for certified/specialty soy products.

Government initiatives

- EU and national funding for sustainable-soy certification systems, traceability initiatives, and port modernization to support faster handling and compliance checks for feed/food imports.

India & Southeast Asia (regional demand & processing): India and several Southeast Asian countries import soy products for crushing, edible oil production, and feed. Regional crush capacity and domestic crop cycles affect the volumes imported vs. domestically crushed. India’s import profile also includes significant soybean meal and oil shipments for the feed sector.

Key statistics

- Regional import tonnages for meal/oil and raw beans are in the multi-hundred-thousand to million-tonne ranges annually, with variability by country and season.

- Consignment profiles: both large bulk shipments for crushers and multiple small imports for edible-grade or specialty product lines.

Government initiatives

- National policies on edible oil reserves, import duties, and crush-sector incentives, along with trade facilitation at key ports to support feed and food supply chains.

Soybean Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Growth Rate from 2025 to 2034 | CAGR of 4.5% |

| Market Size in 2025 | USD 208.64 Billion |

| Market Size in 2026 | USD 218.03 Billion |

| Market Size by 2034 | USD 310.07 Billion |

| Dominated Region | Asia Pacific |

| Fastest Growing Region | North America |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Soybean Market Segmental Analysis

Nature Analysis

The GMO segment led the soybean market in 2024 due to increasing crop production, developed crop-growing producing systems, and increased production of genetically modified seeds for mass production of crops like soybeans. Such factors have helped in the high production of the crop, which is helpful to fulfill the protein and nutritional requirements of the region. The crop also plays a major role in enhancing the nutritional value of animal feed and livestock, which is further helpful for the market’s growth. The solvent extraction method helps to separate the oil from the meal, which is further helpful for the growth of the market.

The non-GMO segment is expected to grow in the foreseen period due to higher demand from consumers for naturally perceived options. Many consumers understand the importance of non-GMO products for their health as well as for environmental benefits. Hence, such factors further help to fuel the growth of the soybean market in the foreseeable period. Transparency in the food industry, allowing consumers to gain complete information about the food products, further fuels the market’s growth.

Form Analysis

The processed soybean segment led the soybean market in 2024 due to an array of its benefits, further fueling the growth of the market. The processed soybeans in the form of tofu, soy milk, and soy oil are high in protein, helpful for consumers to maintain their nutritional profile and complete their protein intake for the day. Soybeans are low in carbohydrates and also have a low glycemic index, further fueling the industry’s growth. Hence, the segment had a major role in the growth of the market.

The raw segment is expected to expand in the foreseen period due to the versatility of the crop, making it essential for different industries. The crop is also used for the manufacturing of biofuels, inks, plastics, adhesives, crayons, and different types of industrial materials, further fueling the growth of the market in the foreseeable period. Soybeans are also essential for animal feed and for livestock. It helps to maintain the nutritional levels of cattle and poultry, further fueling the market’s growth in the foreseeable period.

By End-Use

The animal feed segment led the soybean market in 2024 due to its importance for the animal feed and livestock industry. The addition of soybeans to the animal feed helps to make it nutritious and healthy for animals. Hence, it further helps to enhance the quality of milk and meat derived from them. The ideal balance of amino acids and other nutritional properties helps animals to absorb the maximum nutritional properties from the feed, and livestock is helpful for the market’s growth.

The food and beverages segment is expected to grow in the foreseen period as soybean is utilized for the production of milk, powders, flavor additives, and different types of plant-based food options, which are helpful for the market’s growth in the foreseen period. Vegans and plant-based diet followers make a major contribution to the growth of the market, as the crop is high in protein and other nutritional elements. The ingredient is also useful for the manufacturing of baked, canned fish, and various other products, fueling the growth in the foreseeable period.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Tea Market: The global tea market size is projected to expand from USD 30.25 billion in 2025 to USD 54.68 billion by 2034, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034

- Beverage Packaging Market: The global beverage packaging market size is projected to reach USD 271.80 billion by 2034, growing from USD 173.71 billion in 2025, at a CAGR of 5.1% during the forecast period from 2025 to 2034.

- Gluten Free Food Market: The global gluten free food market size increasing from USD 14.25 billion in 2025 and is expected to surpass USD 33.59 billion by 2034, with a projected CAGR of 10% during the forecast period from 2025 to 2034.

- Canned Wines Market: The global canned wines market size is expected to increase from USD 127.88 million in 2025 to USD 332.46 million by 2034, growing at a CAGR of 11.2% throughout the forecast period from 2025 to 2034.

- Bakery Product Market: The global bakery product market size is rising from USD 507.46 billion in 2025 to USD 821.62 billion by 2034. This projected expansion reflects a CAGR of 5.5% during the forecast period from 2025 to 2034.

- Coconut Products Market: The global coconut products market size is expected to climb from USD 14.18 billion in 2025 to approximately USD 33.71 billion by 2034, growing at a CAGR of 10.1% during the forecast from 2025 to 2034.

- Pet Food Market: The global pet food market size is expected to increase from USD 113.02 billion in 2025 to USD 167.97 billion by 2034, growing at a CAGR of 4.5% throughout the estimated timeframe from 2025 to 2034.

- Organic Food Market: The global organic food market size is expected to grow from USD 253.96 billion in 2025 to USD 660.25 billion by 2034, with a compound annual growth rate (CAGR) of 11.20% during the forecast period from 2025 to 2034.

Top Companies in the Soybean Market

- Bunge Limited – Bunge is one of the world’s largest agribusiness and food companies, playing a key role in soybean origination, crushing, trading, and processing. The company produces soybean meal, oil, and protein ingredients used in food, feed, and biofuel industries. Bunge’s integrated global supply chain and sustainability initiatives position it as a leading force in the global soybean value chain.

- Cargill – Cargill operates one of the world’s most extensive soybean sourcing, crushing, and refining networks, supplying soy-based proteins, oils, lecithin, and meal for food, feed, and industrial applications. The company’s focus on traceable, sustainable soy production and partnerships with farmers enhances its leadership in global soybean trade and processing.

- Archer Daniels Midland Company (ADM) – ADM is a global leader in soybean processing and value-added soy products, producing soy protein concentrates, isolates, and oil derivatives for food, beverage, and feed markets. The company invests heavily in sustainable sourcing and alternative protein technologies, reinforcing its position in the global soy protein and oil segments.

- Louis Dreyfus Company (LDC) – Louis Dreyfus Company is a major soybean trader and processor, operating across the full value chain from origination to logistics and merchandising. LDC produces soybean meal and crude oil, supplying both animal feed and edible oil markets. Its focus on supply chain efficiency and sustainability certification strengthens its competitive standing in the global oilseed sector.

- Wilmar International Limited – Wilmar is a leading agribusiness and integrated processor in Asia, handling soybean crushing, refining, and specialty oil production. The company’s downstream operations span food processing, oleochemicals, and biodiesel, making it a dominant player in the Asian soybean oil market.

- Amaggi Group – Based in Brazil, Amaggi is a major soybean producer, processor, and exporter, managing large-scale soy cultivation, logistics, and commodity trading operations. The company emphasizes sustainable farming, traceability, and zero-deforestation supply chains, aligning with global ESG trends in agricultural production.

- SLC Agrícola – SLC Agrícola is one of Brazil’s largest agribusiness producers, cultivating soybeans for both domestic processing and international export. The company’s vertically integrated operations and adoption of precision agriculture and sustainability practices make it a key player in Latin America’s soybean supply network.

- AG Processing Inc. (AGP) – AG Processing is a U.S.-based cooperative engaged in soybean processing and agricultural marketing. The company produces soybean meal, refined oil, and renewable fuels, with an emphasis on farmer ownership and regional supply chain efficiency.

- CHS Inc. – CHS is a farmer-owned cooperative that manages soybean processing, refining, and export operations. The company provides soy meal, oil, and biodiesel products, serving both domestic and global markets. Its integration from farm to export gives it a strong position in North American soy value chains.

- Bayer AG – Through its Crop Science division, Bayer develops genetically improved soybean seeds resistant to pests, diseases, and herbicides. The company’s biotech innovations and digital agriculture platforms enhance yield potential, sustainability, and farm productivity for soybean growers worldwide.

- Corteva Agriscience – Corteva focuses on soybean seed innovation and crop protection solutions, offering advanced seed genetics and trait technologies under its Pioneer® brand. The company’s focus on climate-smart agriculture and seed performance optimization positions it as a leader in soybean farming inputs.

- DuPont (part of Corteva legacy) – DuPont’s historical contributions to the soybean market include the development of high-protein and disease-resistant soybean varieties, as well as biotechnology and seed coating technologies that continue under Corteva’s research portfolio.

-

Syngenta Group – Syngenta provides crop protection products, biologicals, and digital farming solutions tailored to soybean cultivation. The company’s seed treatment and pest management innovations help optimize yields and sustainability, supporting growers across major soybean-producing regions.

Segments Covered in the Report

By Nature

- GMO

- Non-GMO

By Form

- Raw

- Processed

By Application

- Food & Beverages

- Animal Feed

- Industrial Use

- Others

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5528

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies | FnB Market Pulse | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us:

Discover More Market Trends and Insights from Towards FnB:

➡️Beverage Flavors Market: https://www.towardsfnb.com/insights/beverage-flavors-market

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Europe Nutraceuticals Market: https://www.towardsfnb.com/insights/europe-nutraceuticals-market

➡️Canned Food Market: https://www.towardsfnb.com/insights/canned-food-market

➡️Non-Alcoholic Beverages Market: https://www.towardsfnb.com/insights/non-alcoholic-beverages-market

➡️Dry Fruit Market: https://www.towardsfnb.com/insights/dry-fruit-market

➡️Frozen Meat Market: https://www.towardsfnb.com/insights/frozen-meat-market

➡️Fish Oil Market: https://www.towardsfnb.com/insights/fish-oil-market

➡️Soft Drink Concentrates Market: https://www.towardsfnb.com/insights/soft-drink-concentrates-market

➡️U.S. Halal Food Market: https://www.towardsfnb.com/insights/us-halal-food-market

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.